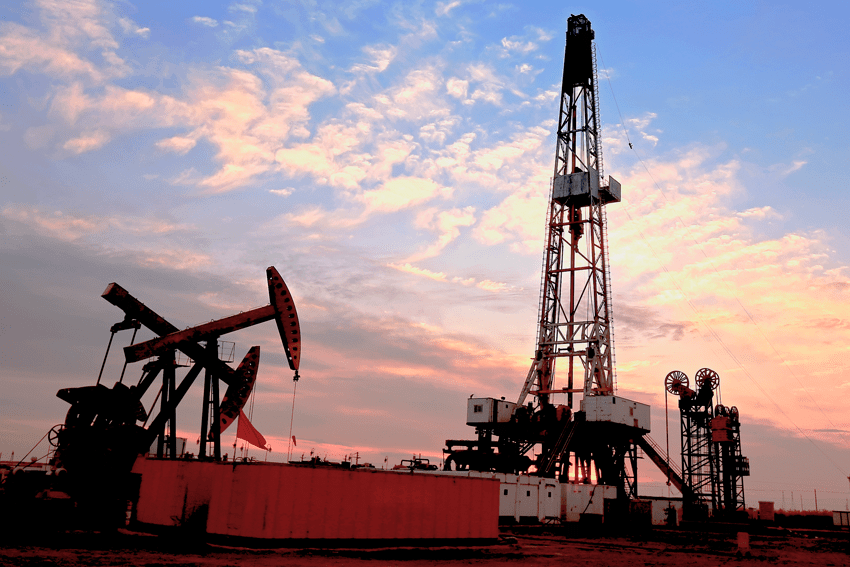

Petrobras sells oil fields in northeast Brazil

Author:Luis Bulcao Pinheiro

Source: Latin Lawyer

27 August 2019

Machado Meyer Advogados has helped Petrobras sell its exploration and production rights to the onshore and offshore Macau cluster in the state of Rio Grande do Norte to local private equity firm Starboard Asset.

Campos Mello Advogados advised the buyers, which established a special purpose company named 3R Petroleum to manage the fields.

The deal was made through a competitive auction. Starboard’s bid offered to pay Petrobras US$191 million in two instalments. The first, worth US$48 million, was paid on 9 August, when the deal was signed. The second US$143 million tranche will be paid when the deal closes.

The Macau cluster covers seven oil fields. Petrobras had a 100% stake in all but one, Sanhaçu, which it shared with Petrogal. Petrogal will retain its 50% in that field. The cluster’s combined daily production is 5,800 oil barrels.

The sale is part of Petrobras’ comprehensive divestment programme. Its most recent deals include the sale of a controlling stake in fuel distributor BR and the divestment of the Enchova and Pampo and Baúna oil fields. Both transactions took place in July. In June, the company sold gas pipeline TAG for US$8.7 billion in one of Latin America’s biggest M&A deals to date in 2019.

More is to come. Petrobras is already conducting bids for two oil fields in the Espírito Santo basin, northeast of Rio de Janeiro. On 17 September, Petrobras will auction ships and equipment. The company has also announced bid proceedings for 11 shallow water oil fields in Rio’s Campos basin, along with plans to sell 11 oil refineries and its gas retail company Liquigas.

Counsel to Petrobras

In-house counsel – Alexandre Yukito e Daniela Mourão

Machado Meyer Advogados

Partners Decio Pio Borges De Castro, Daniel Szyfman and Arthur Bardawil Penteado, and associates Antonio Carlos Amorim Castello Branco, Fernando Fernandes Xavier and Raphael Barboza Correia.

Counsel to Starboard Asset

Partners Marcus Bitencourt, Fabio Campos Mello, Paulo Lopes and Jorge Gallo, and associates Renata Amorim Barbara Bittencourt, Tatiana Pasqualette and Flavia Ferreira.

Comentários