TAX AND INSURANCE ALERT

Dear clients,

On 8 August 2018, Private Letter Ruling No. 91/2018 was published by the Brazilian Tax Revenue, as a response by the General Coordination of Taxation (“COSIT”), which revokes Private Letter Ruling No. 62/2017.

The Response to Consultation No. 91/2018 clarifies the way in which reinsurance companies are taxed, according to the different ways of operation in Brazil.

I – REINSURANCE OPERATIONS IN BRAZIL

COSIT has issued in this Private Letter Ruling the tax treatment to be applied to the reinsurance activities in Brazil.

According to Section 4 of Supplementary Law No. 126/2007, reinsurers can be exercised by legal entities, national or foreign, as follows:

- local reinsurer: reinsurer headquartered in Brazil incorporated as a corporation (sociedade anônima – “S.A.”), with sole purpose of carrying out reinsurance and retrocession;

- admitted reinsurer: a foreign reinsurer, with a representative office in Brazil, which has been registered by the insurance supervisory authority as such upon compliance with the requirements established in the Supplementary Law and with the applicable rules to carry-out reinsurance and retrocession activities in Brazil, and

- occasional reinsurer: a foreign reinsurer headquartered abroad, without a representative office in Brazil, which has been registered by the insurance supervisory authority as such upon compliance with the requirements established in the Supplementary Law and with the rules applicable to reinsurance and retrocession activities in Brazil.

II –TAXATION OF REINSURERS

Last year, COSIT had issued in the Private Letter Ruling No. 62/2017 that the admitted reinsurer should be taxed similarly to a local reinsurer. However, according to the new Private Letter Ruling No. 91/2018, the admitted reinsurer will only be taxed as a local reinsurer when the activities are carried out by a legal representative who is in fact exercising their full binding authority the admitted reinsurer. Please note that pursuant to Resolution CNSP No. 168/2007, the legal representative of the representative office is given the authority to represent the admitted in Brazil, which may or may not be exercised in practice.

On the other hand, the Private Letter Ruling No. 62/2017 provided that only payments to the occasional reinsurer would be taxed as importation of services, subject to Withholding Income Tax (Imposto de Renda Retido na Fonte – “IRRF”) and Taxes on Revenue and Imported Services (PIS-Importation and COFINS-Importation). However, according to the new Private Letter Ruling No. 91/2018, IRRF and Taxes on Revenue and Imported Services are applicable to the occasional reinsurer and to the admitted reinsurer, that carries out limited activities through the representative office.

The changes brought by the Private Letter ruling No. 91/2018 arises from an official letter sent by SUSEP to the Brazilian Tax Revenue, which informed that even though the applicable regulation gives the legal representative of the representative office powers to bind the admitted reinsurer in Brazil, in practice there are representative offices of admitted reinsurers that only carry out commercial representation for the admitted reinsurer, being used solely for the relationship with SUSEP, sorting out regulatory issues or providing technical and commercial support to the reinsurer based abroad. Therefore, such legal representatives did not have, in fact, any commercial or operational autonomy to underwrite business, execute agreements, receive or pay premium or claims. Such core activities were carried out only by the admitted reinsurer abroad and not in Brazil.

Upon receiving this information on the way admitted reinsurers in fact operate in Brazil, the Brazilian Tax Revenue distinguished the legal representatives of the admitted reinsurers that use their binding authority in Brazil from those that carry out limited activities in support to the admitted reinsurer business.

In cases where the legal representatives use their binding authority to bind the admitted reinsurer, such activities will be taxed as a local reinsurer. This means that, if a reinsurance agreement is executed by the legal representative of the admitted reinsurer’s representative office in Brazil, the premium payable to the admitted reinsurer will attract the same taxation due in case the placement was made to a local reinsurer. On the other hand, if the representative office is not being used for such core activities (i.e. final underwriting decision and execution of reinsurance agreements) than the taxation on premium payable to the admitted reinsurer will follow the rules applicable to the occasional reinsurers.

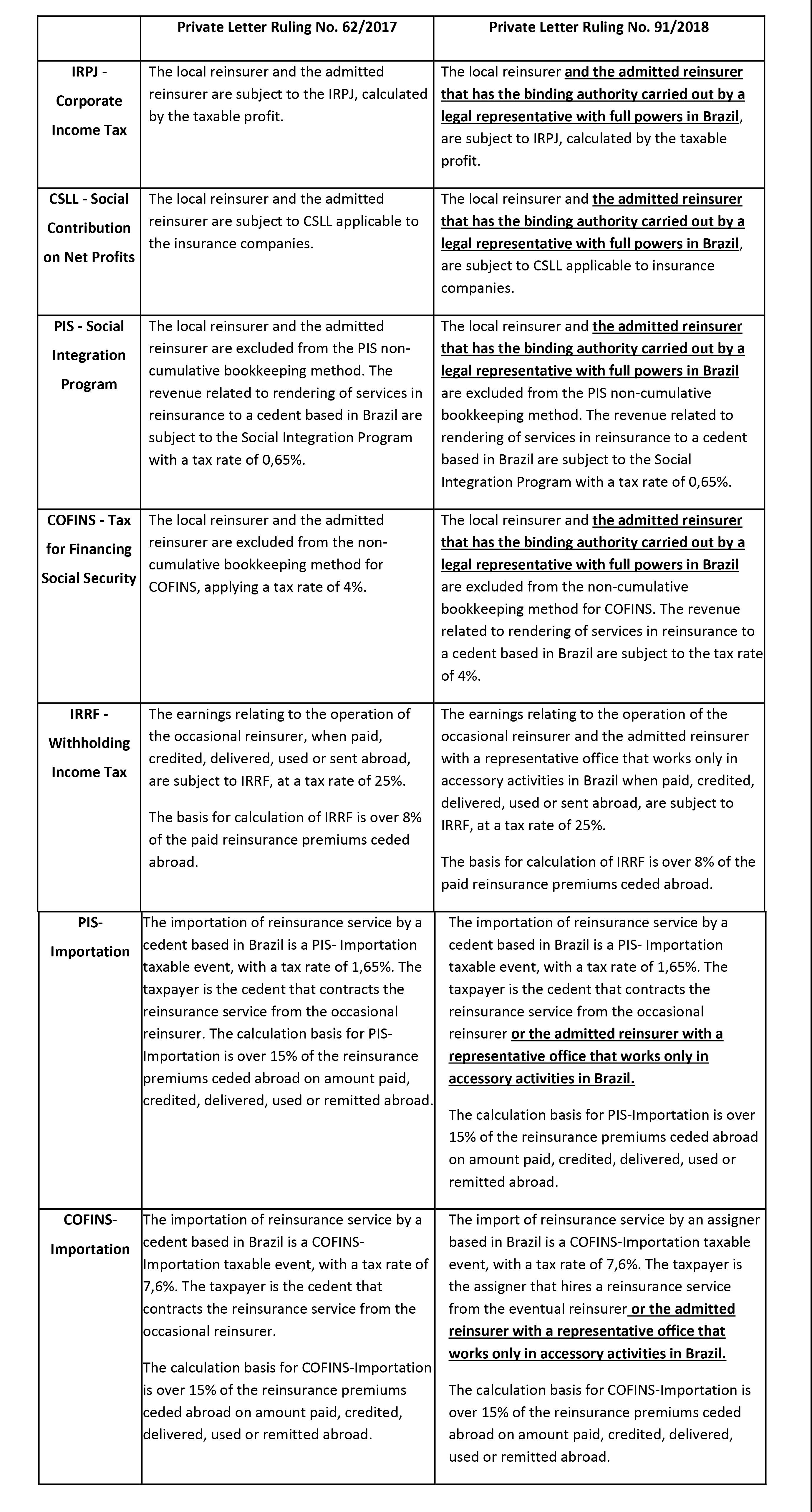

The taxation of reinsurers is summarized in the table below, which compares the differences between Consultation No. 62/2017 and the new Consultation No. 91/2018.

CONTACTS:

Alex Moreira Jorge – partner

alex.jorge@cmalaw.com

Humberto Lucas Marini – partner

humberto.marini@cmalaw.com

Leonardo Rzezinski – partner

leonardo@cmalaw.com

Renato Lopes da Rocha – partner

rlopes@cmalaw.com

Rosana Gonzaga Jayme – partner

rosana.jayme@cmalaw.com

Marcella Hill – partner

marcella.hill@cmalaw.com

Comentários